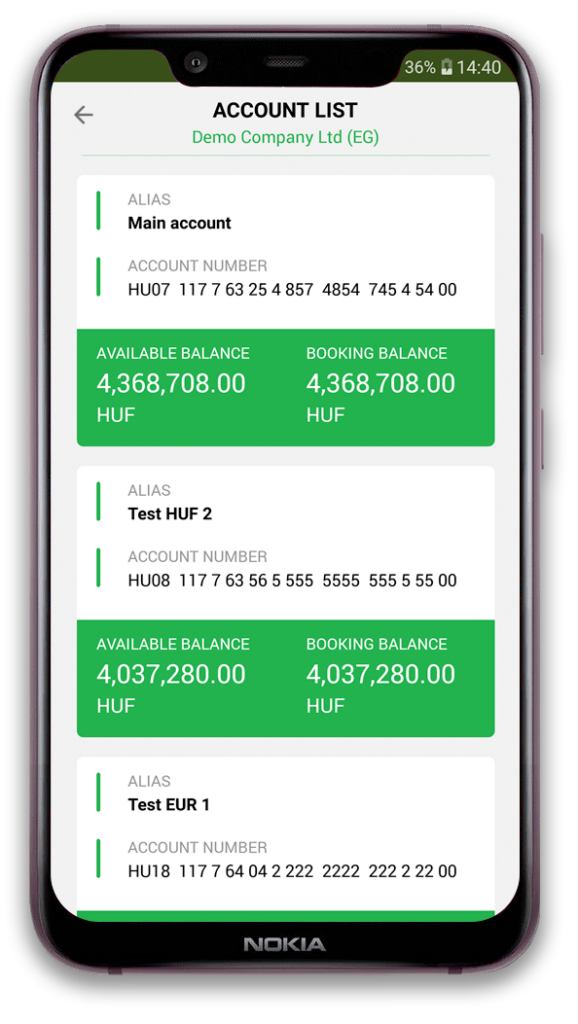

for any size of businesses

CORPEX helps any size of businesses with simplifying their day-to-day financial processes. Company size specific features and modules available for small businesses and large enterprises.

25 years of continuous improvement

We redesigned CORPEX to meet the unique requirements of our professional customers. With 25+ years of experience on the European market, the 4th generation of our product offers comprehensive solutions.

Functional improvements were inspired by continuous interaction with our customers to ensure that we are always cognizant of the current market needs.

CORPEX’s competitive advantages include the range of exceptionally high-level banking services, the security of operation as well as the adaptability to the particular needs of Your customers.

We have practices in the Czech Republic, Poland, Hungary, Russia, Slovakia and Ukraine, which enables us to ensure compatibility with local regulations and legal frameworks.

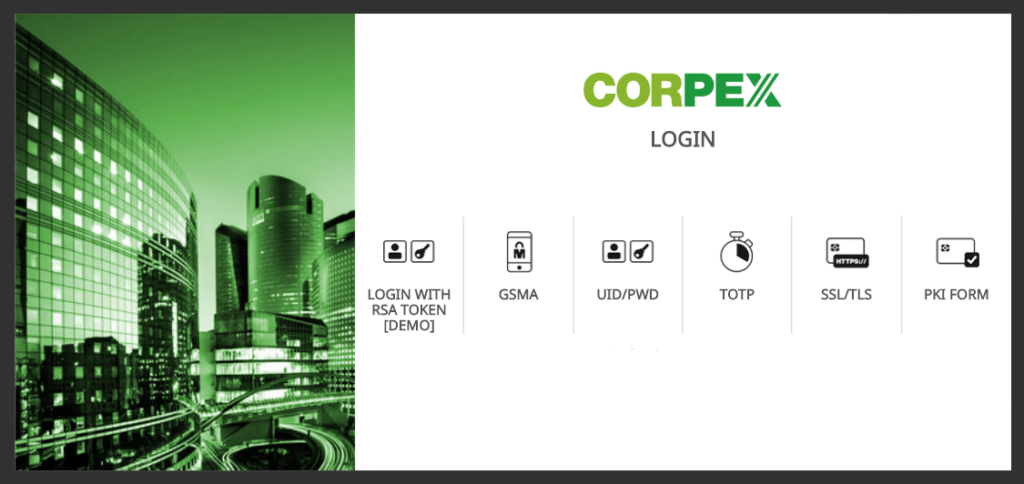

ADVANCED SECURITY

Certified authentication and signature modules ensure the security of our client’s users, which allows using different authentication methods during log-in and transaction signature and enables cross-border onboarding capability.